Such an agreement prevents the borrower from taking on too much new debt, which could limit the original creditor’s ability to collect. Not only that, companies with a high debt-to-equity ratio may have a hard time working with other lenders, partners, or even suppliers, who may be afraid they won’t be paid back. As noted above, it’s also important to know which type of liabilities you’re concerned about — longer-term debt vs. short-term debt — so that you plug the right numbers into the formula. Other companies that might have higher ratios include those that face little competition and have strong market positions, and regulated companies, like utilities, that investors consider relatively low risk.

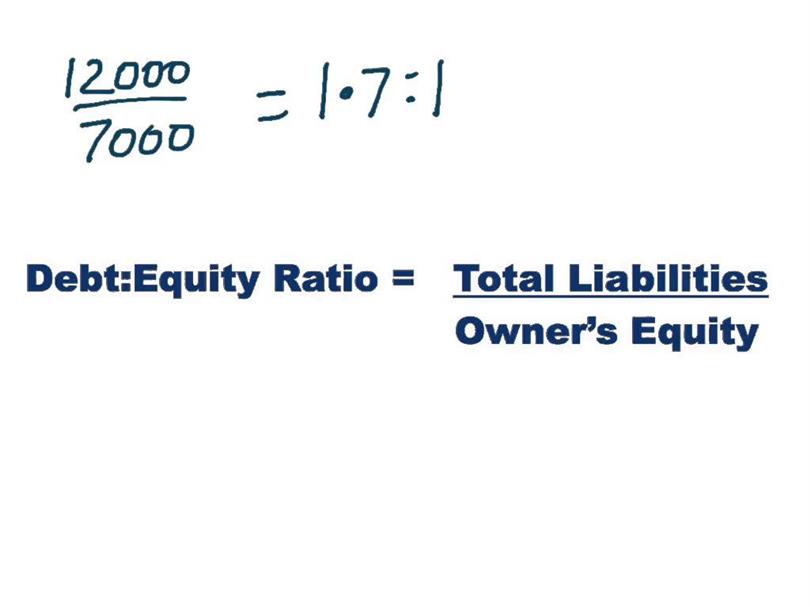

How to Calculate the Debt-to-Equity Ratio

The debt-to-equity ratio is most useful when used to compare direct competitors. If a company’s D/E ratio significantly exceeds those of others in its industry, then its stock could be more risky. For example, a prospective mortgage borrower is more likely to be able to continue making payments during a period of extended unemployment if they have more assets than debt.

Why Is Debt-to-Equity Ratio Important?

Conversely, a lower ratio indicates a firm less levered and closer to being fully equity financed. A steadily rising D/E ratio may make it harder for a company to obtain financing in the future. The growing reliance on debt could eventually lead to difficulties in servicing the company’s current loan obligations.

How do you interpret debt-to-equity ratio?

Depending on the industry they were in and the D/E ratio of competitors, this may or may not be a significant difference, but it’s an important perspective to keep in mind. This means that for every $1 invested into the company by investors, lenders provide $0.5. For startups, the ratio may not be as informative because they often operate at a loss initially. In this guide, we’ll explain everything you need to know about the D/E ratio to help you make better financial decisions. InvestingPro offers detailed insights into companies’ D/E Ratio including sector benchmarks and competitor analysis.

Cheaper Than Equity Financing

Companies in the consumer staples sector tend to have high D/E ratios for similar reasons. These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. Because the ratio can be distorted by retained earnings or losses, intangible assets, and pension plan adjustments, further research is usually needed to understand to what extent a company relies on debt. It’s important to analyse the company’s financial statements, cash flows and other ratios to understand the company’s financial situation. However, it is important to note that financial leverage can increase a company’s profits by allowing it to invest in growth opportunities with borrowed money. So, a company with low debt-to-equity ratio may be missing out on the potential to increase profits through financial leverage.

- A company’s total debt is the sum of short-term debt, long-term debt, and other fixed payment obligations (such as capital leases) of a business that are incurred while under normal operating cycles.

- Since debt financing also requires debt servicing or regular interest payments, debt can be a far more expensive form of financing than equity financing.

- While some very large companies in fixed asset-heavy industries (such as mining or manufacturing) may have ratios higher than 2, these are the exception rather than the rule.

- When making comparisons between companies in the same industry, a high D/E ratio indicates a heavier reliance on debt.

As you can see from the above example, it’s difficult to determine whether a D/E ratio is “good” without looking at it in context. It’s clear that Restoration Hardware relies on debt to fund its operations to a much greater extent than Ethan Allen, though this is not necessarily a bad thing. This figure means that for every dollar in equity, Restoration Hardware has $3.73 in debt. The following D/E ratio calculation is for Restoration Hardware (RH) and is based on its 10-K filing for the financial year ending on January 29, 2022.

This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used. Interest payments on debt are tax-deductible, which means that the company can reduce its taxable income by deducting the interest expense from its operating income. It is the opposite of equity financing, which is another way to raise money and involves issuing stock in a public offering. Many startups make high use of leverage to grow, and even plan to use the proceeds of an initial public offering, or IPO, to pay down their debt.

It is considered to be a gearing ratio that compares the owner’s equity or capital to debt, or funds borrowed by the company. A high D/E ratio indicates that a company has been aggressive in financing its growth with debt. While this can lead to higher returns, it also increases the company’s financial risk. Conversely, a low D/E ratio suggests that a company has ample shareholders’ risk response plan equity, reducing the need to rely on debt for its operational needs. This indicates that the company is primarily financed through its own resources, reflecting strong financial stability and a lower risk profile. The debt-to-equity ratio divides total liabilities by total shareholders’ equity, revealing the amount of leverage a company is using to finance its operations.

Other definitions of debt to equity may not respect this accounting identity, and should be carefully compared. Generally speaking, a high ratio may indicate that the company is much resourced with (outside) borrowing as compared to funding from shareholders. The D/E ratio can be classified as a leverage ratio (or gearing ratio) that shows the relative amount of debt a company has. As such, it is also a type of solvency ratio, which estimates how well a company can service its long-term debts and other obligations.

Industries that are capital-intensive, such as utilities and manufacturing, often have higher average ratios due to the nature of their operations and the substantial amount of capital required. Therefore, it is essential to align the ratio with the industry averages and the company’s financial strategy. For instance, utility companies often exhibit high D/E ratios due to their capital-intensive nature and steady income streams. These companies frequently borrow extensively, given their stable returns, making high leverage ratios a common and efficient use of capital in this slow-growth sector.

In summary, computing the Debt to Equity ratio is essential for assessing financial health and risk. Companies should regularly evaluate their ratio to ensure it aligns with their strategic goals. A high Debt to Equity ratio can lead to increased interest expenses and financial instability.